Every so often someone will ask me what I would recommend they invest in. There’s a lot of ways this question is phrased, and it’s not always so direct. …

The original Pokémon was after my time, I must confess (with not a hint of sadness). Without the nostalgia to suck me in to the Pokémon Go fad, I …

I often get asked where I’d recommend others invest their assets for the best returns, with the least amount of risk (of course). “Low-risk, high-returns!” has a certain ring …

Update: the AmEx offer for a free Sam’s Club membership as highlighted below is no longer active, however, there is currently a great 50% off membership offer available. Separately, …

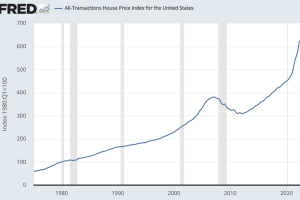

I was casually reading a local news article on housing prices across the Michigan market when I noticed something odd – in every major city that I checked, the …

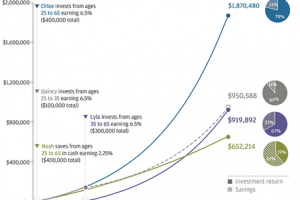

One of the biggest sentiments I encounter when chatting about retirement savings with others goes a little something like this, Ahhh. I’m young – I’ve got plenty of time …

If you’ve spent any amount of time reading personal finance advice, you’ve surely come across gurus or opinionated individuals with an unwavering faith in the power of income to …

Update: the vouchers and discount codes from the Ticketmaster Class Action settlement are no longer active – but I will leave all of the settlement details below for historical …