Category: HSAs

I’ve been a huge advocate for health savings accounts (HSAs) for many years. While I worked for a MegaCorp, I participated in a high deductible health plan (HDHP) and …

This maximum HSA contribution overview has been updated with info for the 2024 and 2025 tax years. If you’ve been following this site, you know that I have long …

Looking for the best HSA account in 2024? We’ve got your covered. If a Health Savings Account (HSA) hasn’t been top of mind – there really is no better …

This FSA-eligible qualified medical expense overview is updated with information for the 2023 and 2024 tax years. Similar to health savings accounts (HSAs), the big benefits that healthcare-related flexible …

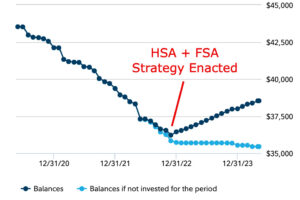

This HSA overview has been updated with info for the 2024 & 2025 tax years. A few years ago, I moved from a traditional PPO health insurance plan to …

This HDHP overview has been updated with info for the 2024 and 2025 tax years. I previously mentioned that I had moved to a new high deductible health plan …

This FSA overview has been updated with information for the 2024 tax year. I’ve gone in to great detail on my love for health savings accounts (HSAs), but also …

When is the HSA Contribution Deadline for 2023? The Same Day as the 2024 Tax Deadline. As a follow-up to my IRA contribution deadline post, I wanted to make …