Category: FSAs

I’ve been a huge advocate for health savings accounts (HSAs) for many years. While I worked for a MegaCorp, I participated in a high deductible health plan (HDHP) and …

This FSA-eligible qualified medical expense overview is updated with information for the 2023 and 2024 tax years. Similar to health savings accounts (HSAs), the big benefits that healthcare-related flexible …

This FSA overview has been updated with information for the 2024 tax year. I’ve gone in to great detail on my love for health savings accounts (HSAs), but also …

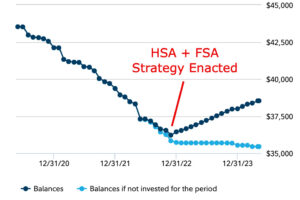

In recent years, our household has shifted from one employer’s high deductible health plan (HDHP) paired with a health savings account (HSA), to another employer’s PPO plan, which is …

Update: the below content is applicable for 2021 to 2022 FSA carryovers. The maximum FSA carryover for 2023, 2024, and future years has reverted to 20% of the maximum …

CARES Act OTC Medication & Feminine Hygiene Product Qualified Medical Expense Changes One of the lesser known but potentially high impact COVID-19 relief measures within the Coronavirus Aid, Relief, …

This FSA Carryover Rule overview is updated with information for 2023 to 2024 and 2024 to 2025 FSA carryovers. We’ve previously covered the basics on flexible spending accounts (FSAs), …