Category: Taxes

As many of us have been dreading, the federal tax deadline is coming soon (Monday, April 15, 2024). With few exceptions (e.g. if you’ve filed a tax extension or your income …

The Inflation Reduction Act Changed Both Federal Energy Tax Credits (Residential Clean Energy Credit & Energy Efficient Home Improvement Credit) This energy tax credit overview has been updated for …

This Child Tax Credit overview has been updated with all of the latest details on the Child Tax Credit, Additional Child Tax Credit, Adoption Tax Credit, and Child & …

When is the HSA Contribution Deadline for 2023? The Same Day as the 2024 Tax Deadline. As a follow-up to my IRA contribution deadline post, I wanted to make …

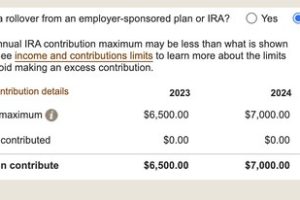

When is the 2023 IRA Contribution Deadline? The Tax Filing Deadline in 2024. Here’s a personal finance 101 must-know special: the deadline for IRA contributions for a calendar year …

An FYI (or reminder) to those who make charitable donations, in part, with tax deduction benefits in mind: the $300 above-the-line “universal” charitable donation tax deduction expired at the …

An FYI to readers, as I’ve had a number ask me the question recently, “What happened to Credit Karma Tax?”. Credit Karma Tax was renamed and recently fully relaunched …

Update: the 2024 Federal Poverty Level (FPL) Guidelines have been updated for this article (below). 2023 FPL Guidelines are also included for reference. Every January, the United States Department …