Category: Retirement Planning

As outlined in my recent Safe Withdrawal Rate post, answering the “How much do I need to retire?” question is critically important for anyone who wants to retire some …

I’m excited to finally unleash my Safe Withdrawal Rate overview as I believe this financial concept can be life changing, when used properly. Note that the safe withdrawal rate …

One of the biggest sentiments I encounter when chatting about retirement savings with others goes a little something like this, Ahhh. I’m young – I’ve got plenty of time …

This spousal IRA overview article has been updated with information for the 2025 tax year. I’m willing to bet that most readers of this article have heard of a …

It wasn’t long ago that I blasted the traditional 10% savings plan advice given by financial gurus that recommends you work until traditional retirement age (65+), save 10% along …

According to 77% of 226 investment advisors, in a recent survey, the low bar for what Gen Y (millennials) should save for retirement is $2 million. One author and …

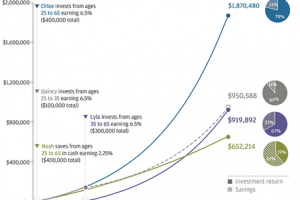

$1 saved in your twenties can be the equivalent of $10 saved in your fifties, if invested over time. Hard to believe? It’s true. Actually, $10.06 to be exact …

Who doesn’t want to earn at least a little bit more than they are right now? Back when I made $35,000 a year, I’d look to the goal of …