Category: Taxes

What is an IRS Identity Protection PIN (IP PIN)? The start of tax season has arrived, and I wanted to share a PSA for readers that the IRS is …

Update: there was no tax extenders legislation passed for the 2024 tax year as of January 2025. Most of what was included in the prior tax extender legislation passed …

Update: the universal tax donation deduction has expired, as of the end of 2021 as we have not seen legislation extending the universal charitable tax deduction. If there are …

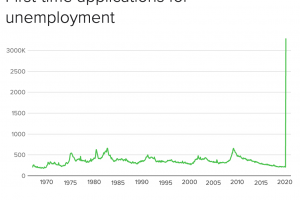

Update: most of what is highlighted in this article has expired, but I will leave it up for historical reference. Additionally, a 2nd COVID relief bill was passed, H.R. …

This W-4 overview has been updated for the 2025 tax year. The only time that the IRS’s Form W-4 typically enters our stream of consciousness is when we reluctantly …

With the tax deadline upon us, Tax Refund Windfall Syndrome is back in full force! Last year’s average tax refund was up to $3,138. You won’t be getting a …

This overview on how to file an amended return on your taxes with the IRS has been updated for 2025. What if <gasp> you unexpectedly receive a tax form …

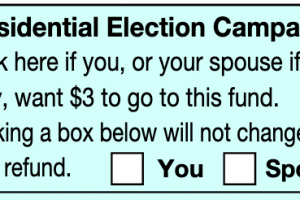

This article on the Presidential Election Campaign Fund has been updated for the 2024 and 2025 tax years. Most taxpayers who have filed their own taxes are probably somewhat …