Category: IRAs

A few weeks back, I was having a chat with a younger friend who raised the following: I was hoping to talk about 401K vs saving money to have …

I was having lunch with a co-worker a while back, and the exhilarating topic of retirement accounts came up. Our employer offers a generous 50% 401K match, which led …

If you have self-employment income, SEP IRAs (SEP stands for “Simplified Employee Pension”) are a great vehicle for turbo-charging your retirement savings while simultaneously reducing your tax obligation. Along …

This backdoor Roth IRA article has been updated with information for the 2024 tax year. In it, we’ll cover the basic Backdoor Roth IRA details, how-to steps, and whether …

This spousal IRA overview article has been updated with information for the 2023 and 2024 tax years. I’m willing to bet that most readers of this article have heard …

Update: Due to court ruling, the new fiduciary rules highlighted below were struck down in court, in early 2018, and are no longer applicable. However, the rest of the …

Me: Forgive me father, for I have sinned. Father Finance: You are in a safe place to share your sins, my son. What would you like to confess? Me: …

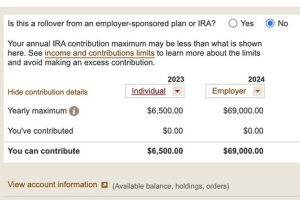

Have you ever wondered, “Hmmm… can I roll this retirement plan over to that retirement plan”? Retirement plan rollovers can be confusing. Sometimes there are goofy rules around when …